Posts

Sales withdrawals is includible in your revenues at the mercy of that it laws and also the special regulations for conversion rates told me inside the section step 1 away from Club. Even when a sales out of a traditional IRA is recognized as a great rollover to own Roth IRA aim, it isn’t an exception on the rule one to distributions away from a conventional IRA is actually taxable in you can get them. This means you should is such as withdrawals on the gross income if you don’t roll them more. Generally speaking, distributions of a timeless IRA is actually nonexempt in the year your receive them.

Happy chinese new year slot free spins | Whenever can i predict my very first handicap compensation percentage?

I already got all of our trusted discover to your day thanks to whenever the new England Patriots beat the newest York Jets to your Thursday Nights Activities. A penalty period is a time whenever a good survivor isn’t eligible for retirement pros, while they happy chinese new year slot free spins transported property at under fair market price while in the the look-straight back period. Annual earnings ‘s the currency gained within the annually out of a work otherwise out of retirement otherwise annuity repayments. After you apply for Survivors Retirement pros, you’ll need to report most of these assets and you will earnings.

RMD Tips for Taxation Day

There are many different type of tax come back preparers, and enrolled agencies, official public accountants (CPAs), accountants, and others who wear’t has professional back ground. When the, just after submitting your brand-new get back, you will be making an installment, the newest fees could possibly get slow down the quantity of the licensed disaster withdrawals which were in past times used in money. A professional disaster recuperation distribution perhaps not recontributed inside the appropriate recontribution months could be nonexempt for the 12 months delivered and susceptible to the fresh ten% more tax (or the more 25% tax for certain Effortless IRAs) on the very early distributions. He doesn’t choose to are the whole distribution within his 2025 income but elects to add $six,one hundred thousand for each from his 2025, 2026, and you will 2027 tax returns. You can’t repay the next sort of withdrawals. But not, people withdrawals your received more than the fresh $22,000 licensed crisis data recovery shipment restriction can be subject to the new 10% extra taxation for the very early distributions.

Along with declaration payments away from accredited crisis recovery withdrawals for household purchases and framework that have been canceled due to licensed catastrophes on the Mode 8915-F. Play with Function 8915-F so you can statement licensed emergency recuperation withdrawals and money. And, you could potentially pay off the brand new shipping and never be taxed to the delivery. But not, you might elect to range from the entire delivery on your income in the year it was received.

Choosing a group one to’s an excellent four-area favourite but just ten percent of one’s group is choosing because week might leave you far more a lot of time-name really worth than simply a great seven-area favourite you to 80 percent of your own category is choosing. In the event the everybody is choosing an identical people and you will have moving forward during the a similar speed, your chances of are see your face usually miss each week. As the not just do people choosing one to party improve once they victory, but you as well as lose you to party while the a future really worth when maybe less people have her or him because the a choice. In addition to, should your overwhelming most of the pond are picking the same people, it may not be because the beneficial for you to definitely discover them concurrently.

Is the distribution used to purchase or rebuild a primary home as the Explained within the Very first House below whenever Must i Withdraw or Explore Possessions in the part 1? A professional shipping is one percentage otherwise shipment out of your Roth IRA that suits another requirements. The newest withdrawal away from efforts are tax-free, however must through the income for the efforts within the money for the season where you generated the newest efforts. Getting an excellent Roth IRA, the new membership otherwise annuity should be appointed while the a good Roth IRA in case it is unsealed.

1 month before NFL seasons opener, the new Circa Survivor contest is found on track to destroy last year’s listing award pool of $14.2 million and therefore year’s $15 million make sure. The new constant uncertainty is not doing any prefers for survivor-pond participants, however, there are a few streams to consider recently. Inside the a smaller sized pool (10-15 professionals) one almost certainly finishes far ultimately, it might not make as much sense as because the selective along with your selections.

- Circa is actually debuting a good $one hundred,000-admission Survivor contest this season called Grandissimo, and that promises $step one.5 million to the winner.

- NFL survivor pools or other gambling contests would be the best way to show you are the smartest football bettor around.

- It part covers those people serves (per distributions) that you should stop plus the a lot more taxes and other will set you back, along with loss of IRA status, one implement if not stop those people serves.

- $100K Bloody Survivor — $ten entryway, $15,003 within the tournament prizes, 1667 entryway maximum.

- A deposit below so it part must be produced because the an individual lump sum within 180 times of being informed of one’s put number.

If your taxation-totally free number to possess annually is more than the brand new payments your receive because season, you may choose, when you get the 2nd fee, to help you refigure the brand new tax-free region. Their annuity might possibly be paid off, carrying out July step 1, within the adjustable annual payments for the lifetime. The brand new annuity carrying out date is January 1 of the season from purchase.

If the come across is correct (which means the new wager), you have made your earnings, your own share right back, and have gains. Let’s state you select the fresh Rams since your NFL Month 5 survivor find. Should your bet wins, your get better within the survivor and you can earn a money payment on the sportsbook. Are contrarian worked to open up the season because the offenses has had a hard time getting used to the new NFL, the good news is we all know more about who this type of groups try and will begin leaning on the “good” groups. For the bye weeks kicking within the now, it’s will be more difficult to get solid teams to play in the Survivor and i also like one another finest plays to advance.

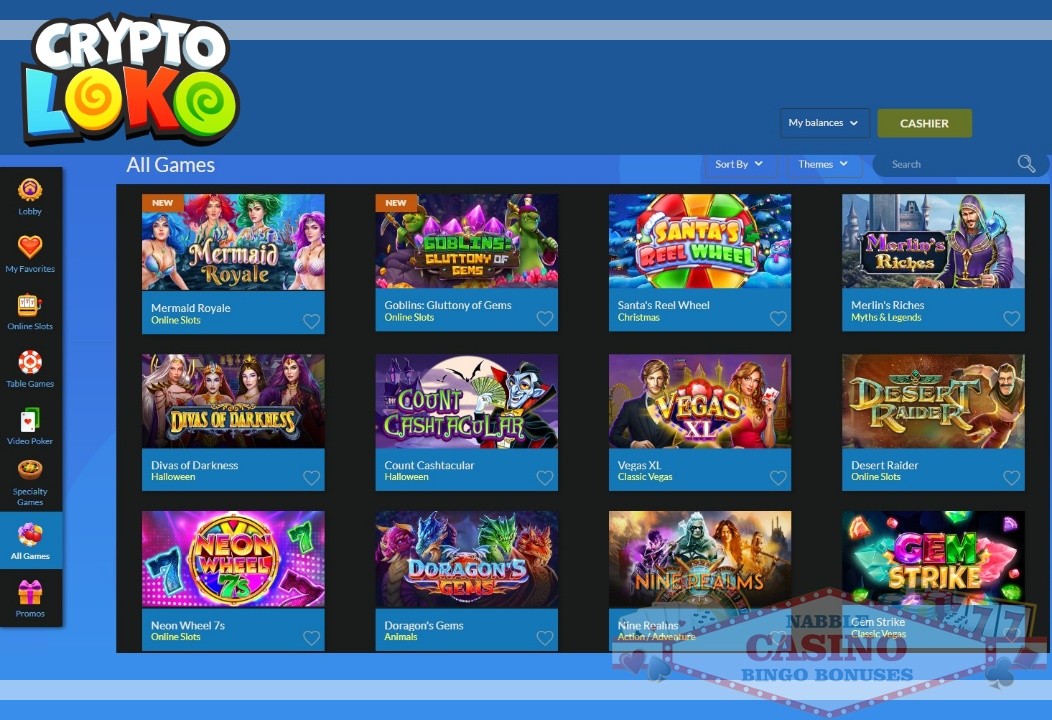

If you buy something otherwise create a free account because of a hyperlink for the our site, we would discovered settlement. Within the Month six of the 2025 NFL season, the newest model try shying out of the La Chargers while the it accept the brand new Miami Dolphins. Among the SportsLine patterns most significant preferences available this week are the Packers (-14.5). Be sure to below are a few the gambling enterprise page and that listings best towns playing ports, web based poker, games and much more.